Polymarket's Fee Structure: Undercutting Kalshi and What It Means

Polymarket's Second Act: Can It Outsmart the Regulators (Again)?

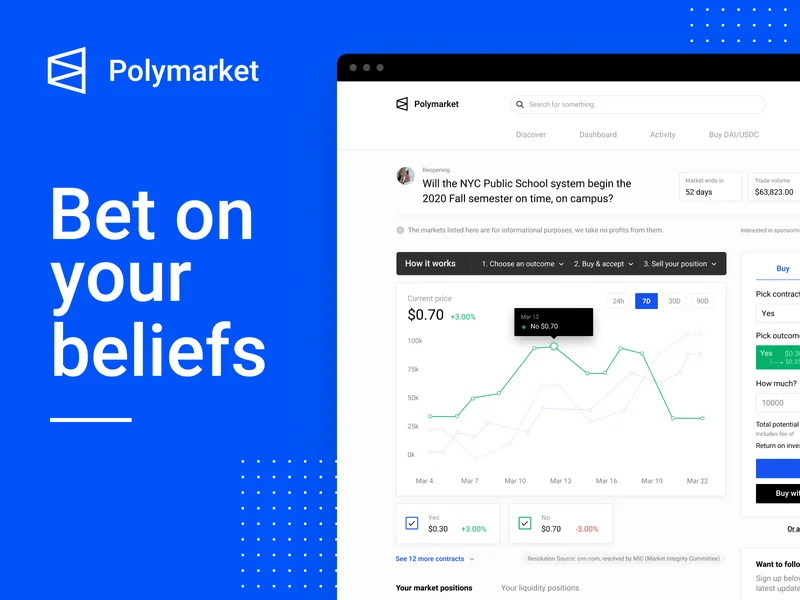

Polymarket, the blockchain-based prediction market, is gearing up for a U.S. relaunch slated for the end of November 2025. The platform, known for letting users bet on real-world events, is emerging from a regulatory shadow that saw it fined $1.4 million by the CFTC in 2022 for operating without a license. Now, armed with new funding, a CFTC-licensed company acquisition, and a revamped fee structure, Polymarket is betting it can play by the rules this time.

Monthly active traders on Polymarket hit a record high of 477,850 in October 2025, and monthly volume surged to $3.02 billion. This surge in activity, coupled with the launch of 38,270 new markets, suggests a pent-up demand for event-driven prediction markets. Nick Ruck at LVRG Research noted a surge in activity as crypto traders explored strategies around liquidity providing, arbitrage, and information asymmetry. But let’s be clear: airdrop announcements, which tend to precede platform token releases, often artificially inflate these metrics. Traders flood in, trying to meet eligibility criteria, which means that the actual, organic interest might be lower than the headline numbers suggest.

The Regulatory Tightrope

The key to Polymarket's U.S. comeback hinges on its ability to navigate the regulatory landscape. The acquisition of QCEX for $112 million is a clear signal of intent. But the timing is tricky. Polymarket submitted new contracts for self-certification to the CFTC on October 1, 2025, coinciding with the start of the government shutdown. The CFTC's inability to process these self-certifications during the shutdown throws a wrench into the works. This is a classic example of regulatory risk – something no amount of funding can completely mitigate.

Consider Kalshi, Polymarket’s main competitor. Kalshi surpassed Polymarket's monthly volume in October 2025 with $4.4 billion. More impressively, Kalshi raised $300 million earlier in October 2025 at a $5 billion valuation, and there are reports that venture capital investors are offering valuations up to $12 billion. The discrepancy is stark: Kalshi's fees are around 1.2% of contracts traded, while Polymarket is touting a fee of just 0.01%. That's more than 100 times higher! It’s a race to the bottom on fees, but can Polymarket sustain that? And more importantly, is it sustainable while maintaining regulatory compliance? Polymarket Reveals Fees For Upcoming US Exchange, Undercutting Rival Kalshi - Yahoo Finance

The Tokenomics Gamble

Polymarket is planning to launch a native POLY token and accompanying airdrop. Airdrops are designed to incentivize early adoption and reward loyal users. (Think of it as a digital loyalty program.) But airdrops also come with risks. They can attract mercenary capital – traders who are only interested in the free tokens and have no long-term commitment to the platform. The success of the POLY token will depend on its utility within the Polymarket ecosystem and the platform's ability to retain users beyond the initial airdrop hype. And this is the part of the report that I find genuinely puzzling. How will they justify the token's value? What real utility will it provide beyond speculative trading?

The involvement of figures like Donald Trump Jr. (as an advisor through 1789 Capital) and early investment from Peter Thiel’s Founders Fund adds a layer of political intrigue. It positions Polymarket as a platform with backing from politically influential players. But does this translate to regulatory immunity? Unlikely. It might offer a degree of political cover, but ultimately, Polymarket will be judged on its compliance with CFTC regulations.

A High-Stakes Game of Prediction

Polymarket's relaunch is not just a story about a company bouncing back from regulatory setbacks. It’s a test case for the viability of blockchain-based prediction markets in the U.S. The platform’s success will depend on its ability to navigate the regulatory landscape, attract and retain users, and build a sustainable business model. The low-fee strategy is bold, but it also raises questions about long-term profitability. The token launch adds another layer of complexity. The question isn't whether Polymarket can generate hype (it clearly can), but whether it can build a sustainable, compliant, and profitable business.

Smoke and Mirrors?

The numbers are impressive, but the long-term viability remains uncertain. The low-fee model is a gamble, the token launch is a potential distraction, and the regulatory hurdles are far from cleared. While the surge in activity is certainly eye-catching, I'm not convinced that it represents genuine, sustainable growth. It feels more like a high-stakes game of prediction, where the odds are still very much in the house's favor.

Tags: polymarket

Uber Stock: What to Watch for in Q3 Earnings

Next Postiren stock: Blockbuster deal with Microsoft?

Related Articles